The Fourth Source:

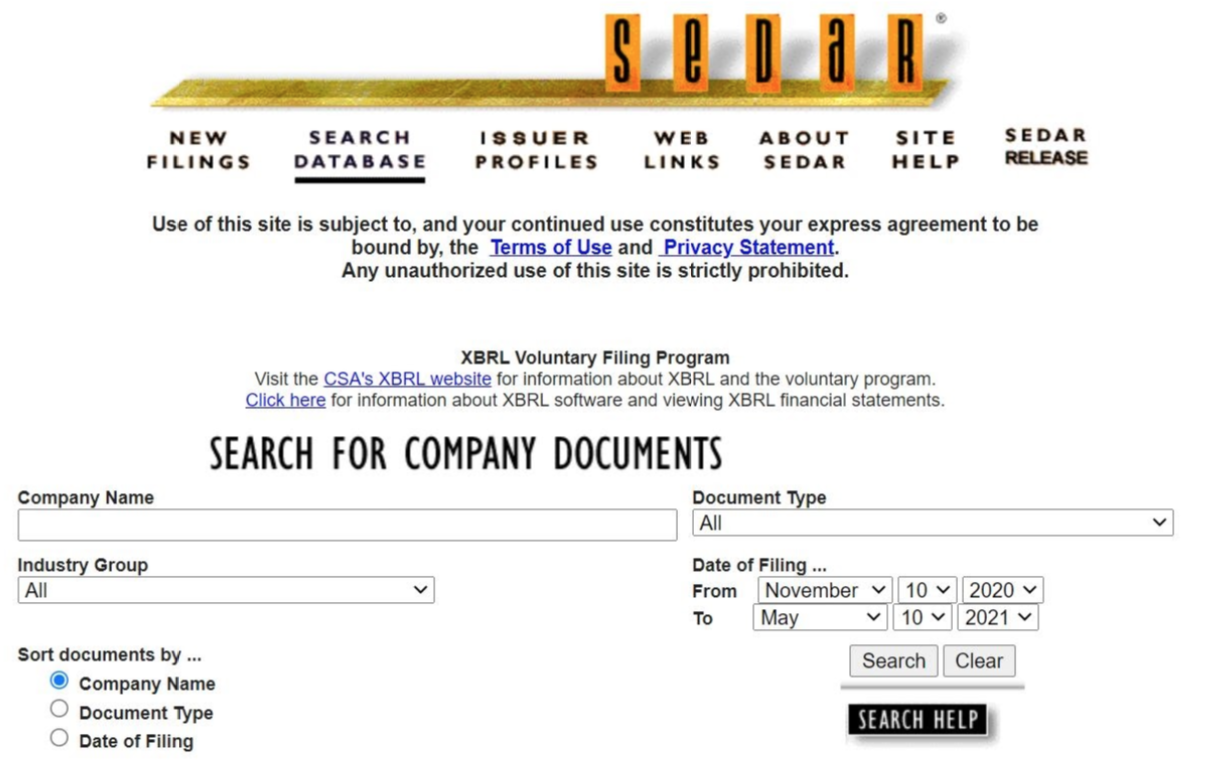

Canada | SEDAR

SEDAR the Canadian equivalent of the SEC, contains numerous filings on public and private companies. Two filings, Form 51-102F3, and Arrangement Agreement Execution Version, sometimes contain valid information, although it is buried in legalese.

Similar to the UK Companies House data, using these documents to cross-reference other sources might make the most sense, and a human-in-the-loop-approach is likely the most promising. Similar to the other government filings, there is not always a perfect match between how entities are named on the government filings and PitchBook’s platform, which might cause some confusion and difficulties for automation

For example, PitchBook lists Trive Capital Fund III as the Investor Funds for Seven Aces, but the Arrangement Agreement Execution Version lists TCFIII LUCK HOLDINGS LLC